Our Services

Comprehensive Retirement, Financial, and Insurance Solutions

Retirement Planning Analyses

Our retirement planning services are designed to provide financial security for your loved ones. With tailored plans and expert guidance from a Certified Elder Law Attorney and National Social Security Advisor, you can ensure peace of mind knowing your family is protected in connection with life’s predictable events.

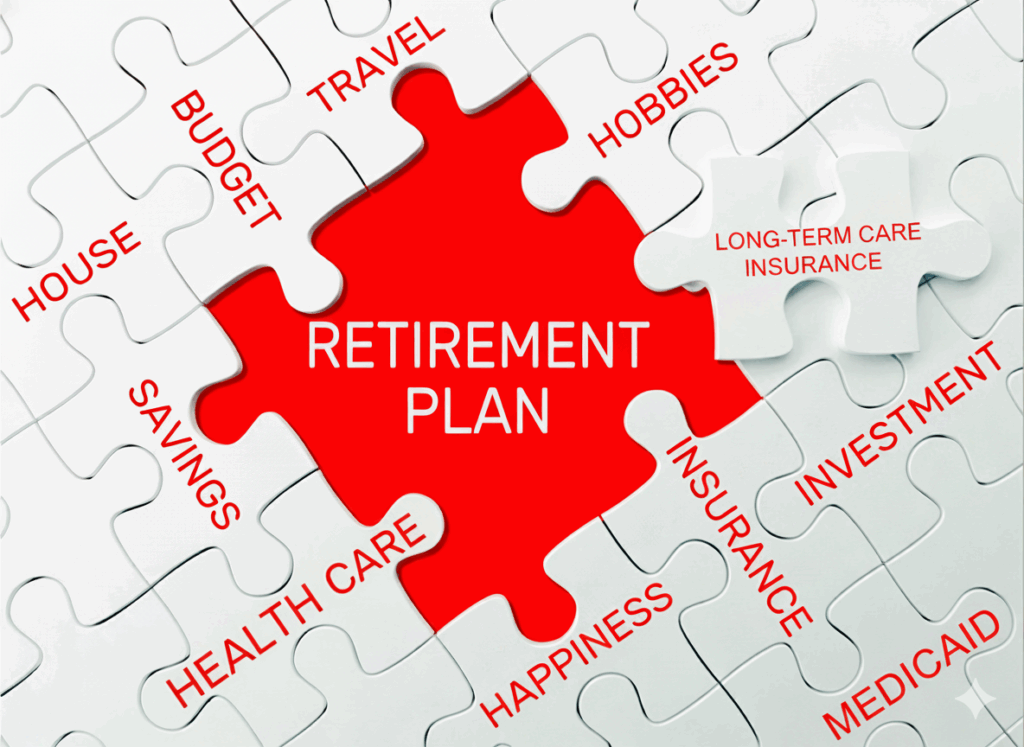

• Long-term Care Analysis – As you can see from the Retirement Plan puzzle to the right, most retirement planners ignore the fact that 70% of the U.S. population will need long-term care for years prior to death, so most so-called “retirement plans” leave long-term care insurance blurry and out of the equation, while also leaving Medicaid out of your plan completely because they don’t understand the incredible benefits of intentionally leveraging long-term care insurance and long-term care Medicaid benefits as part of a good Retirement Plan. We do Retirement Planning right, giving both long-term care insurance and long-term care Medicaid the due place they deserve!

• Roth Conversion Analysis – evaluating whether and when to convert pre-tax retirement funds to a Roth IRA to optimize lifetime and generational tax outcomes.

• Qualified Plan and IRA Liquidation and Asset-Protection Funding Analysis – evaluating whether to liquidate qualified retirement plans (such as 401(k), 403(b), and 457(b) plans) and/or traditional IRAs, pay the associated income tax, and contribute the after-tax proceeds to an irrevocable asset protection trust for Medicaid asset protection, Veterans asset protection, lawsuit asset protection, and estate-transfer purposes.

• Social Security Claiming Optimization – evaluating the best time to claim Social Security Benefits, whether on your employment record or your spouse’s record.

• Important Note – Neither Lifecare Financial Services nor any of its affiliates, including Evan Farr, provide any specific securities recommendations, portfolio-management services, or discretionary trading authority over client accounts, nor do they implement any investment transactions.

Life Insurance

Our life insurance services are designed to provide financial security for your loved ones. With tailored plans and expert guidance from a Certified Elder Law Attorney, you can ensure peace of mind knowing your family is protected against unforeseen events.

Long-Term Care Insurance

Protect your savings and secure your future with our long-term care insurance options. We provide personalized plans that cater to your specific needs and budget, ensuring you receive the necessary care without compromising your financial wellbeing.

Medicaid-Compliant Annuities

We manage the complexities of Medicaid with our Medicaid-compliant annuity products when appropriate as part of an overall Medicaid asset protection plan. Our expertise in elder law enables us to use these specialized legal-financial structures to qualify you or your spouse for benefits while protecting your financial resources.

Funeral Trusts

Plan ahead with our prepared funeral trusts, alleviating the financial burden on your loved ones during a difficult time. We assist you in setting up a trust that ensures your final wishes are honored, providing you and your family with peace of mind.

Secure Your Financial Future with Us Today!

Connect with Lifecare Financial Services to discover customized financial solutions that bring peace of mind and stability to your family.

You must be logged in to post a comment.